Why is it Important to Start Healthy Financial Habits Early?

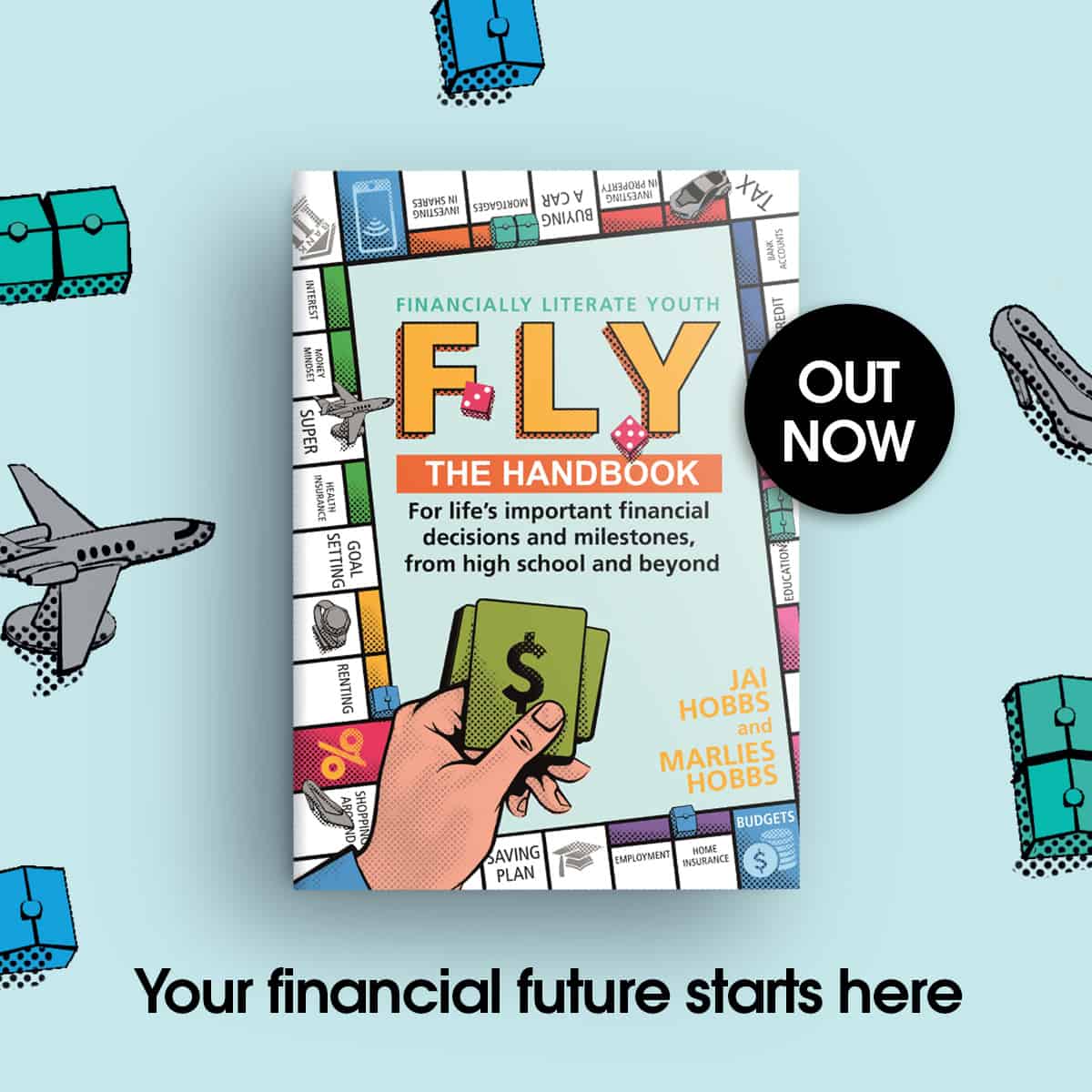

FLY: Financially Literate Youth is a Financial Literacy Handbook for school leavers. It’s written to help educate and empower our youth to FLY into life after school, helping your teen to manage their money. It is the book we wish we had been given in high school to prepare us for the real world. When it comes to finances, too many lessons are learnt the hard way, and it doesn’t have to be that way.

While FLY has been written for school leavers, there is so much we can teach our younger children to help them with the foundations of financial literacy. There is no age too young to start these conversations with our children. As a mother to two boys, Troy (nine) and Zac (six), there have been many such conversations in our house and on car rides. I have loved watching their knowledge and confidence grow.

Having discussed this with several friends and family across a few generations, it seems that in the past, children speaking about money has often been taboo. Parents would respond – ‘that’s none of your business!’ Then those children would fly the nest completely unprepared for what was ahead of them. Thankfully, times are changing. Parents and children are having more open and transparent conversations about money, helping prepare them for life on their own.

The dining table and car rides are a great place to have these conversations. They are a good place to welcome questions from your children about money and how the world works. In general, you should encourage those questions and conversations to help empower and prepare your children for life when they no longer have the security of being tucked safely under your wing.

Being financially literate from an early age can only be a positive, with effects such as:

- Increased motivation

- Goal setting skills

- Work ethic

- Sense of security / understanding / empowerment

- Increased sense of reality

- Appreciation

- Less entitled mindset

- Increased initiative / responsibility

- Sense of purpose

- Sense of contribution

Knowing Where to Start

We can often overcomplicate money talk with our children which makes us stall and not know where to start.

To overcome this, we came up with these five simple principles for educating our children on the foundations of financial literacy:

- What is the Purpose of money? A currency that we exchange for products and services.

- What is the Form and Function of money? ie. Cash, eftpos / savings and credit.

- What is the Value of money? Help them understand what things cost and relate that back to the things they want and their earnings from pocket money / jobs etc.

- How to Earn money? ie. Pocket money jobs, employment, a side hustle etc and have open conversations about the many and varied, wild and wonderful ways that other people earn money.

- How to Save? Keep it very simple to start with – spend less than you earn. eg. 50 percent spend, 50 percent savings, and adjust that as they get older once the savings habit is well established. Work towards the 50/30/20 rule; 50 percent for needs, 30 percent for wants, 20 percent for savings (pg 40 of FLY).

See what resonates with you and develop your own simple structure to help guide you to support your children and the development of their financial literacy knowledge.

FLY: Financially Literate Youth

Once they turn 16, it’s definitely time to read FLY: Financially Literate Youth. It’s a handbook and reference guide like no other, and one they can refer to over and over, as they approach each new financial decision and milestone, from high school and beyond.

FLY: Financially Literate Youth is the perfect handbook for every young person who wants to be armed with the financial knowledge and confidence to set themselves up for success as they chart the course of their life. Whether they are contemplating leaving the nest or are already beginning to spread their wings, this convenient and credible resource will have them prepared for all of life’s milestones, as well as those times when things get rocky or uncertain. And what an uncertain world they’re flying into – but with the right guidance, they can prepare to overcome any obstacle and seize every opportunity! You can purchase your copy of FLY: Financially Literate Youth here and here.

Tune into Episode 99 of the PakMag Parents Podcast with Jai joining Bree to share wisdom and advice on this topic in greater detail.